I’m very pleased to announce the general availability and completion of version 10 of EIS Suite™. Version 10 is the culmination of 12 months of effort from EIS Group employees from all corners of the globe. It demonstrates our continuing commitment to help insurance carriers innovate and operate like a tech company: fast, simple, and agile.

This year, we distributed 17 Agile functional and platform updates for both Accident & Health and Property & Casualty insurers, an accomplishment that we are exceedingly proud of. As you will see from the descriptions below, we enhanced the entire platform and all of our core modules in this version.

After reviewing these new features for Accident & Health insurers, I’m sure you’ll appreciate the value and breadth of functionality that we are delivering. We look forward to a healthy and successful 2020 as we continue to transform both the Accident & Health and Property & Casualty insurance industries with our customer-centric, cloud-native coretech solutions.

On to version 11!

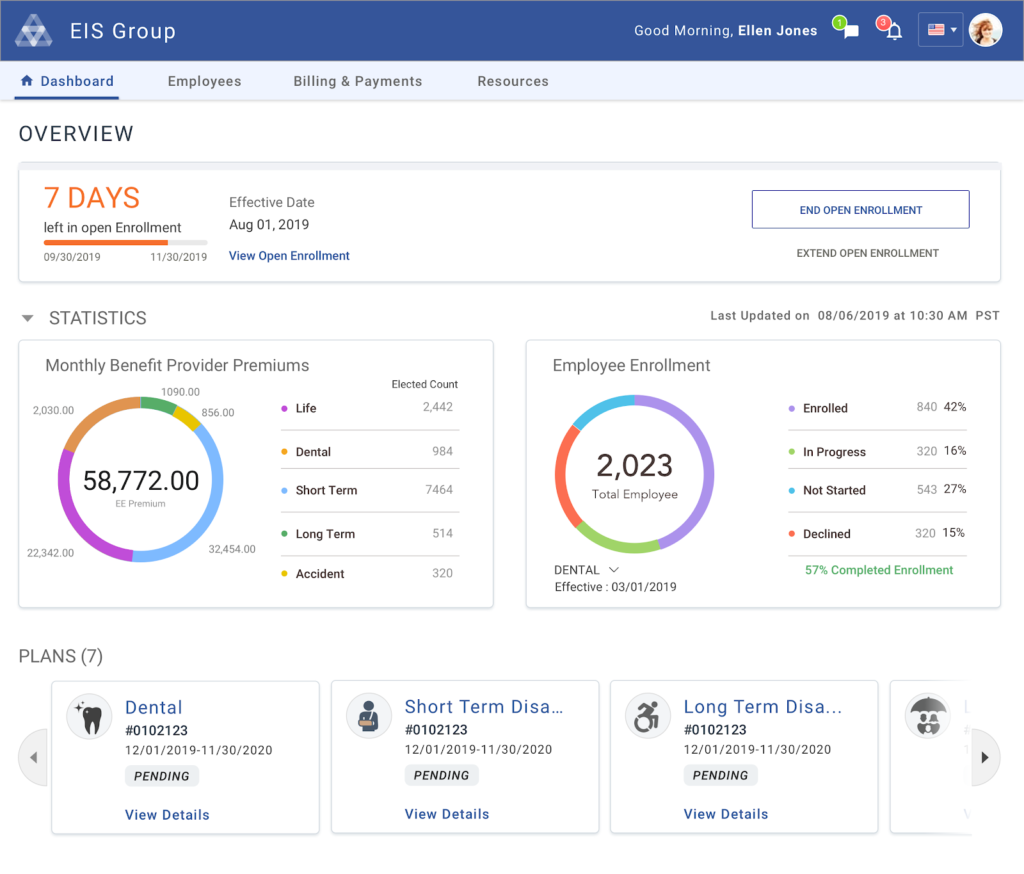

Digital Experience Platform and Persona-Based Apps

As part of our ongoing effort to improve the customer experience, our growing UX/UI team has developed new standards and design systems, which make for excellent consistency, reusability, and productivity increases for insurers and insureds.

In this release, we have made important progress and laid the foundation for more to come with our separately available REACT-based Billing Agent, targeted to individual A&H users, and the Customer Self-Service app.

These customizable user interfaces leverage the same roles and privileges as BillingCore, but with less-concentrated data. This helps users easily zero in on the information they need—in the moment—without compromising on functionality. Additional benefits of this new interface include accelerated training and increased productivity.

“Over three years, we’ve been enhancing DXP™ to support this notion of ‘persona,’” explains Fazi Zand, senior vice president of product management at EIS Group. “It knows who the user is, what they likely are trying to accomplish, and what device they’re using. If there are rules around that persona, it applies them. All of that determines how they interact with the back-end systems.”

- Billing Agent is a new persona-based application that deliver excellent customer experiences via streamlined presentation and data access for billing and claims operations

- Customer Self-Service accomplishes the same goals, with the same methods, but is intended for use by insureds, where an excellent customer experience now is crucial to customer retention and insurers’ success

PolicyCore

PolicyCore® is loaded with new features and benefits, including preconfigured content, Worksite capabilities, and billing location support.

“Preconfigured content helps insurers roll out insurance products more quickly,” says Vinod Paluri, product strategy executive. Version 10 includes preconfigured content for Paid Family Leave, Group Dental, and Group Vision, as well as the ability to configure them with features like split commissions, commission overrides, and the ability to copy commission overrides from one quote to another.

New foundational Worksite capabilities enable rating and pricing at the individual policy level under the employer’s umbrella, including the ability to define policy owner, and apply state rules and appropriate benefits at the employee level. “Now we can support true group products, group voluntary products, and individual Worksite on the same platform for the same carrier,” Paluri says. “Carriers can set up the product once and use it across different channels.”

Additional Benefits

- Split commissions, copy commission override, and rate guarantee renewals for preconfigured products

- Billing location support – List Bill: Gives group insurers the ability to define locations at the case level for all policies by customer. The location attribute is carried to the group and individual levels as well, so insurers can more efficiently perform billing operations at the location level, as well as slice and dice results based on location in combinations with other attributes

- Billing location support – Self Bill: Extends billing by location to Self Bill so insurers can generate an estimated invoice

- Exposes more APIs for quoting processes, making carriers more “digital ready”

- Enhanced capabilities to support general agents and commissions split at each individual agency or broker level

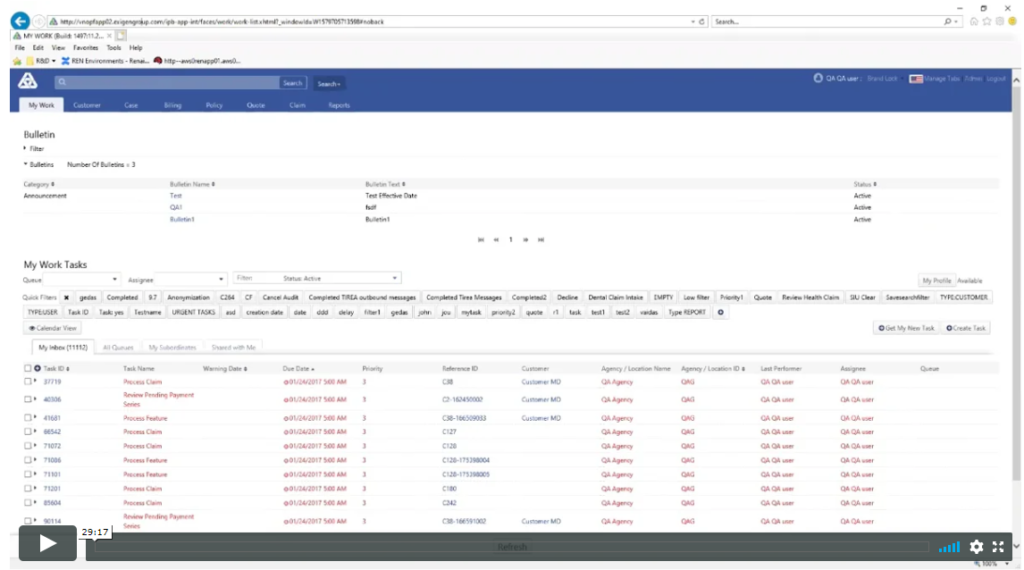

ClaimCore

Version 10 of ClaimCore® incorporates dozens of improvements, including preconfigured content for Paid Family Leave (PFL), and workflow enhancements to dental and disability claims. “We also made many subtle enhancements to the user experience and automation,” says Jim Eva, product strategy executive. “Cumulatively, they offer a substantial opportunity to improve efficiency and effectiveness for insurers who choose the upgrade.”

- New hyperlinks to both the master policy and certificate in the Claim header simplify navigation

- Orthodontic dental claims now feature specific intake rules, batch processing of multiple ortho payments, and the ability to suspend/continue ‘Ortho’ claim life cycle

- Ability to issue monthly payments for orthodontic claims

- An updated dental claim user interface (UI) and lifecycle improves efficiency

- New automated FICA tax withholding capabilities and calculations are available for disability claims

- Automated cost-of-living adjustments and recalculations are available for disability claims

- The application of a participant’s pre-disability calendar workdays to payment logic is now available for disability claims

- Paid Family Leave (PFL) is now available

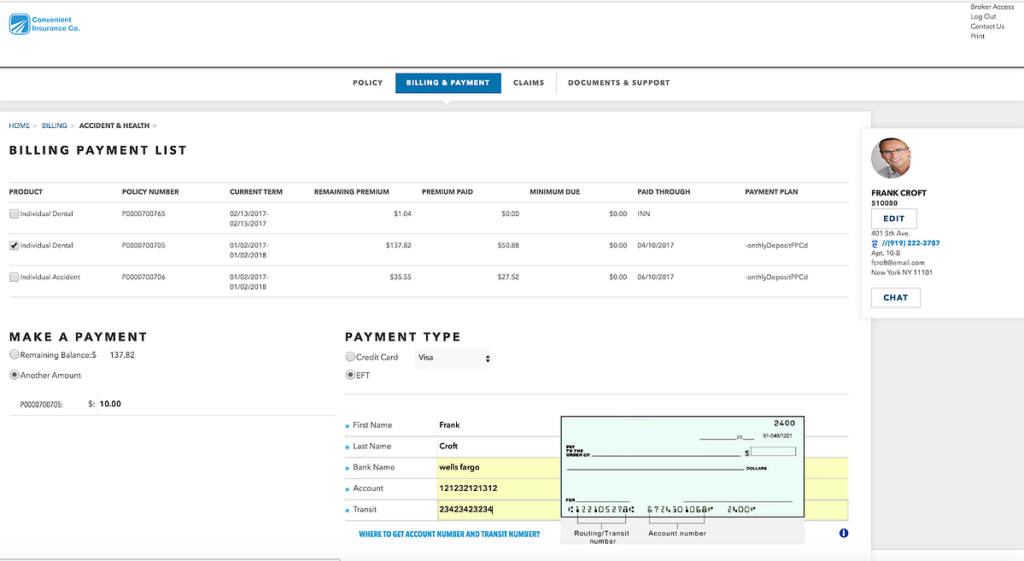

BillingCore

Version 10 of BillingCore® is loaded with new functionality and value for users and insurers. “We’ve made many changes to BillingCore that simplify the user interface, improve the user experience, and streamline processing efficiency,” says Rita Iorfida, vice president of product strategy. “We’re ensuring greater billing accuracy for insurers and their customers by enabling them to create a draft or preview bill at any time during the billing cycle.”

BillingCore’s new ability to generate invoices in a spreadsheet format is useful for insurers who want to create a backup to send to self-bill customers, saving significant time and effort. The ability to generate a draft or preview bill, in both the system and through the portal, smoothes and accelerates workflow, and is a huge benefit to employers and insurers.

Additional Benefits

- Ability to upload a list of payments in a CSV file format through batch processing and automatically allocate payments

- Supports both a grace period and invoice due date concept, resulting in a cleaner communication process through the conservation and delinquency period

- Support for consolidated statement processing, which brings together multiple invoices and bill types for the same customer