EIS now offers insurers the industry’s largest number of core-connected digital APIs in an open architecture to drive digital experience and integration

Recently, EIS announced that the company was now offering 1,100 digital APIs to our customers and partners as part of EIS DXP™, our digital experience platform. Across the board, we believe this milestone surpasses the breadth of API-enabled capabilities put forth by other companies in the core systems space. More important than the number, however, is what our platform allows insurers to build.

Defining Digital APIs

The digital APIs we offer serve as building blocks of the customer experience. Consider each of them to be a Lego brick that corresponds to a particular portion of the policyholder’s entire customer journey. Individually, each block holds unique value, but when combined, they can be turned into a broad and flexible set of user experiences.

To continue the analogy for a moment, we do offer a series of pre-built mobile and web apps that serve as instructions for how to create common experiences (if you’re building a Lego Castle, it’s much easier to let Lego tell you how to do so). But, we also enable our carriers to incorporate these blocks in ways we haven’t considered via EIS DXP’s API Platform and bundled SDKs. By doing so, we are giving our customers the ability to build and test new, innovative offerings, with very little heavy lifting.

Why This Matters

Across the industry, we’re seeing a movement where insurers want to have far more control over the experiences of their policyholder (and prospective policyholder). In the words of our customer, Pascal Lavoie, CIO of Industrial Alliance Auto and Home, “In today’s digital world, our clients want to interact with us on their terms, when and how they choose. They want simplified and convenient interactions that they can start on a mobile device and then continue on the web or via a call center.”

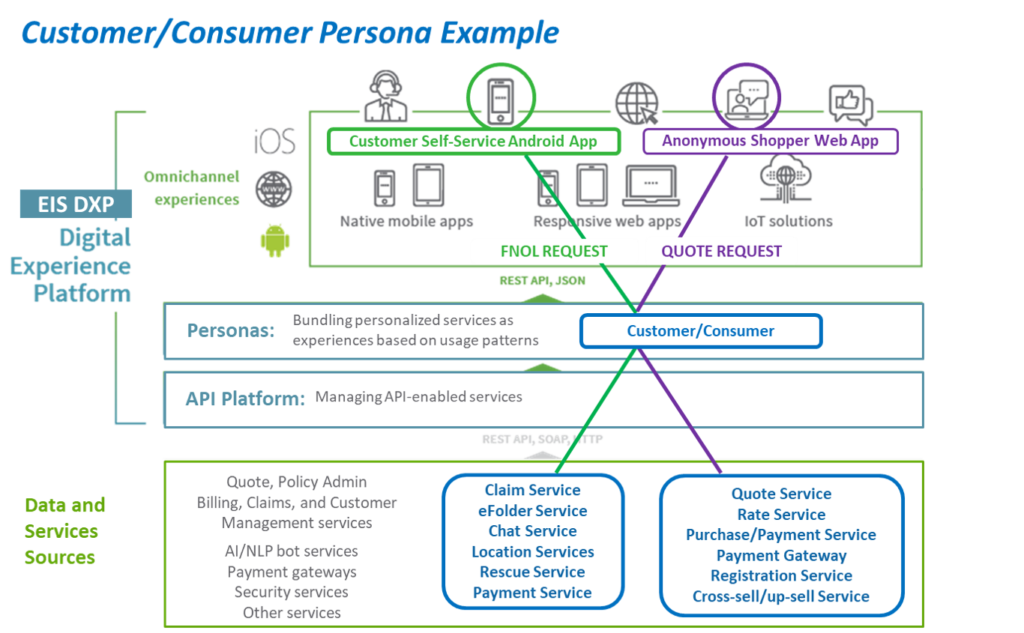

In some cases, this means creating applications that offer products and services directly to consumers that you don’t yet know–via an anonymous shopper app–or to existing policyholders via a customer service app. Many common “blocks” are re-used, but each app also needs to incorporate different API-enabled services to meet the needs of each app user. For example, an anonymous shopper app would not make an API call for a first notice of loss, but a customer self-service app might.

Personas are an essential feature of the customer-first design paradigm within EIS DXP. Personas like the “Customer/Consumer” persona shown in the diagram above bundle API-enabled services as experiences based on specific usage patterns. Persona-based apps for agents, consumers, customers, claims adjusters, underwriters, billing specialists, and other roles are available within EIS DXP.

While it is probably too simplistic to say “anyone can design an insurance application with our APIs,” the reality isn’t that far away. Customer experience and marketing teams can whiteboard their suggested UX, and developers can rapidly re-use the API Platform and Personas to build (and deploy) a solution that meets expectations.

Fun with Numbers

EIS DXP’s 1,100 digital APIs is an impressive number, and it gives insurers a lot to play app Lego with. However, there is another number that enters the equation. When Aite recently recognized the company with top honors for open integration among life and P&C core platforms, they commended us for having more than 10,000 internal and system-to-system APIs built into the EIS Suite™ platform supporting our Life and P&C product offerings (you can download their full report here).

This 10,000 represents the massive connective tissue between EIS Suite’s policy, billing, claims, and customer management functionality. It includes Rest and SOAP connections as well as thousands of regular “events” that take place within EIS Suite. EIS Suite has an event-driven software architecture. Lifecycle processes—such as policies issued, payments made, claims submitted—trigger events. For example, when a policy issue transaction triggers an event message, a document generation system that is a subscriber to that event message will automatically create a policy document.

The relationship between the 1,100 digital APIs and the 10,000 internal APIs is where diverse digital capability flourishes. The digital APIs can make calls to a large but relevant subset of the internal APIs. Consequently, EIS DXP’s API Platform can configure digital apps and experiences from a big Lego-style box of functional blocks.

Pascal Lavoie, referenced earlier, shared his perspective on the value of EIS DXP: “The EIS DXP solution package offers us flexibility and agility while being cost effective. With its comprehensive API/SDK portfolio, we can leverage the product and business rules in our core systems for our digital channels to achieve speed to market at a lower cost. EIS DXP will be the nexus of web services for multiple channels. It also integrates well with other platforms.”

The Future is Open

Unquestionably, the future of insurance is all about openness. Open architecture enables insurers to connect, securely, with systems and data provided in ever-broadening ecosystems: other insurers, distribution partners, insurtech and other vendors, inside and outside of the insurance market. It also allows insurers to access and leverage core operations to profoundly enhance the digital user experience.

Daragh Moran is vice president, Engineering, at EIS.