Despite technological advances making their way into seemingly every corner of business, most protection insurance core systems simply aren’t built to handle both individual and group policies; it’s an either/or situation.

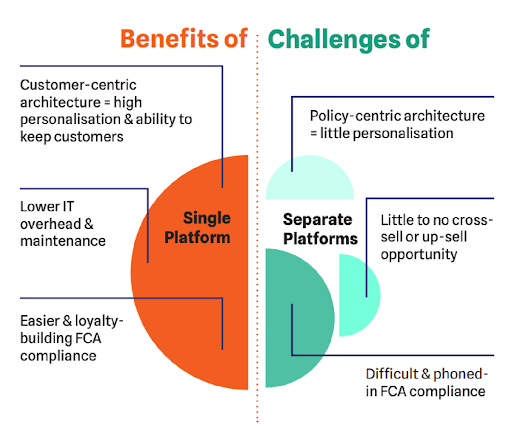

This leaves carriers with a dilemma: choose one policy type and lose out on business in the other; or deal with two separate platforms, which means twice the operating cost and complexity in customer management. The latter option also hampers insurers’ ability to adjust to the market quickly.

On top of that, sustained changes to protection insurance are making the sector more consumer-driven.

As the industry evolves, insurers can look to certain challenges and opportunities to distinguish the long-term winners from the losers, one of which is dual system operations.

A Problem That Needs Solving

Customers’ and companies’ mutual appetite for increased agility and portability with customer protection records isn’t going anywhere, deeming the insufficient support for dual system operations especially ripe for a solution.

Ambitious protection insurers will solve this problem, while those dragging their feet will be left in the dust.

Positive Side Effects of Solving for Dual System Operations

Beyond its agility and portability benefits, having sufficient support for dual system operations provides other perks, too:

- Achieving true customer centricity to better serve individuals

- Staying in line with FCA regulations

The Ultimate Win-Win Solution

A customer-centric architecture gives insurers the freedom to combine workplace and personal protection products together. By letting customers keep their chosen protection products no matter their employment status (freelance, made redundant, unemployed, employed part-time, etc.), this winning combination ultimately aids policyholder retention.

Further, by placing the customer at the centre of your operational model — the way coretech from EIS does — all data revolves around and attaches to a customer’s record. This gives your team a full, 360-degree view of your customers, the policies they purchase (whether part of a group plan or individually), and what life events might affect those policies.

Having a holistic view of each customer gives you the perfect launch pad to make real-time, event-driven communications that keep customers abreast of their coverages. These tailored communications allow customers to make adjustments based on their evolving needs, leaving the FCA very happy.

A No-Brainer for Customer Centricity & FCA Compliance

With sufficient support for dual system operations, insurers no longer need to choose between limiting their business’s growth and incurring more costs and operational complexity.

Customer-centric solutions, like EIS coretech, quench customers and carriers’ mutual need for agility and portability.

Read our comprehensive market overview to learn how you can achieve true customer centricity and FCA compliance for the ultimate win-win.