If the future of insurance is all about offering excellent customer experiences, let’s give the people who know them best the tools to test, learn, and deliver.

Across all lines of business, insurers want to personalize and manage the digital experiences that customers enjoy, whether those customers are agents, brokers, distribution partners, employers, CSRs, policyholders, prospects, or whomever you call “customer.”

Now, before I go any further, I want to assure you that I’m not going to get technical here. With the right no-code tools, business analysts—without IT intervention—now can craft those innovative customer experiences.

Here’s a look at how the pieces come together.

APIs: The Key to Customer Centricity

The connective tissues that allow customers to see and update their own information through a webpage or an app, for example, are called application programming interfaces (APIs). These APIs enable and regulate access to and from data stored in insurers’ core systems and serve as the building blocks of digital customer experiences.

Watch Video: IAAH: Transformation Success from EIS on Vimeo.

Above: IAAH shares how aging technology and outdated processes were hindering their ability to expand market share and improve customer service.

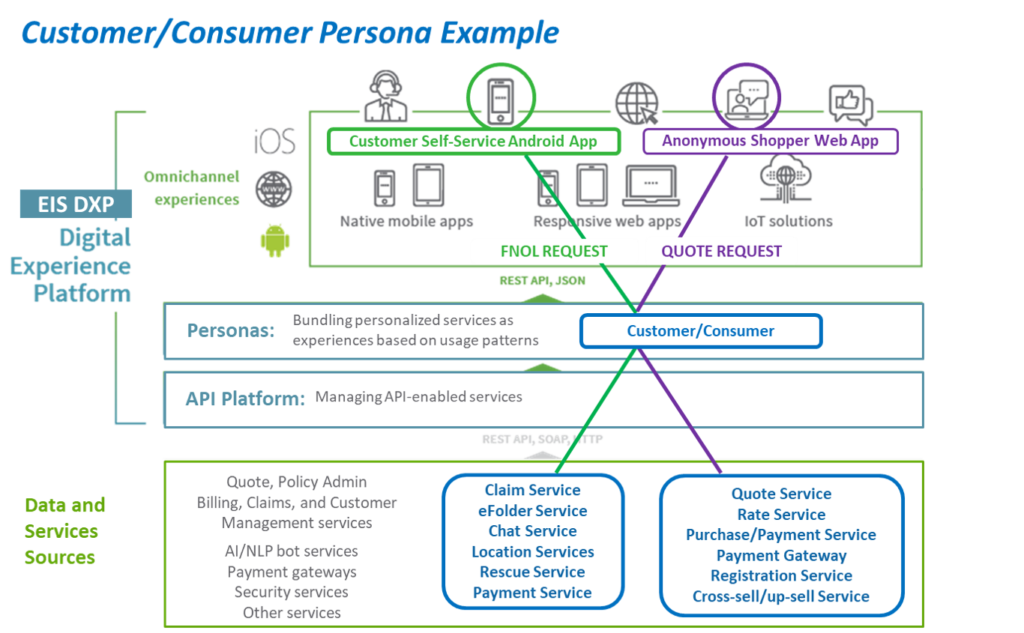

Each API corresponds to a specific individual portion of the policyholder’s customer journey and offers unique value. With a little bit of creativity—and no coding—you can combine and re-use them in different ways to craft many different kinds of user experiences with our digital experience platform, EIS DXP™.

To make this even easier, we offer pre-built, production-ready mobile, and web apps that serve as templates for creating common processes and customer experiences. That way, you can accelerate your projects by simply modifying a tried and tested model, creating new and innovative customer experiences with minimal technical effort. Really.

For some insurers, this will mean the opportunity to create direct-to-consumer applications that offer policies and services to prospects through an anonymous shopper application, for example.

Each reusable app also incorporates different API-enabled services to meet the needs of different user types, also known as “personas.” For example, a customer self-service app might make an API call for an FNOL (first notice of loss), but an anonymous shopper app would not.

Personas are a fundamental concept for customer-centric insurers and within our digital experience platform EIS DXP.

Personas like the “Customer/Consumer,” illustrated above, bundle API-enabled services as experiences based on specified usage patterns. Persona-based apps for agents, billing specialists, brokers, consumers, claims adjusters, customers, underwriters, and others, are available within EIS DXP.

While it’s too early to claim that anybody can design an insurance application with our APIs, the reality isn’t that far away. Customers on the most recent version of EIS DXP now can automatically generate persona-specific REST APIs for any EIS Suite™ functionality that they develop.

This new capability has two important benefits: First, empowered with these new tools, customers now can rapidly build their own persona-based APIs. Perhaps even more exciting: As our customers and implementation teams create, extend, and enhance EIS products, the library of persona-based APIs will grow even more quickly.

More APIs Mean More Insurance Innovation

EIS DXP features more than 1,100 digital APIs, which creates a lot of opportunities for insurers to differentiate themselves from competitors. But that’s not even half the story.

Not long ago, insurance technology analyst group Aite Group bestowed EIS with top honors for open integration among LH&A and P&C insurance core systems and commended us for more than 10,000 internal and system-to-system APIs built into EIS Suite.

Download this Aite Group Perspective: AIM Evaluation: P&C and Life PAS Vendors’ External Third-Party Data Integration

Those 10,000 internal and system-to-system APIs are the connective tissue between our policy, billing, claims, and customer management functionality. That number includes both Rest and SOAP APIs, plus thousands of regular “events” that take place within our event-driven software architecture. For example, when a policy issue transaction triggers an event message, a document generation system that subscribes to that event message then creates a policy document automatically.

When EIS DXP’s 1,100 digital APIs make calls to relevant internal APIs, our “openness” becomes incredibly valuable for creating personalized customer experiences.

“In today’s digital world, our clients want to interact with us on their terms, when and how they choose,” says Pascal Lavoie, CIO of Industrial Alliance Auto and Home, and an EIS customer. “They want simplified and convenient interactions that they can start on a mobile device and then continue on the web or via a call center. With its comprehensive API/SDK portfolio, we can leverage the product and business rules in our core systems for our digital channels to achieve speed to market at a lower cost. EIS DXP will be the nexus of web services for multiple channels. It also integrates well with other platforms.”