Insurers can connect to digital ecosystems and power smart, real-time user experience – what is needed is a cloud-native approach to apps and infrastructure

This we all know by now: cloud infrastructure and services have been critical in the success of the platform-based business models of digital giants’ such as Amazon, Microsoft, and Google. They have created agility, speed, and scale by designing business capabilities to work “natively” in the cloud to get the max from the cloud. The message: becoming a truly successful, customer-focused “digital insurer” requires embracing the ubiquity of cloud innovations.

It is time now for insurers’ applications to take advantage of native cloud capabilities. You may even find it essential to your bottom line. Let’s consider the impact on two elements that are closely related: connecting to digital ecosystems in an era of “sectors without borders” and powering real-time user experience by unifying operations and analytics. Here’s what you need to know.

The rise of digital ecosystems and connecting to them

As existing B2B and B2C commerce ecosystems are evolving and new ones are emerging, insurers are finding they must fundamentally re-engineer their traditional business models into a platform business model. According to business experts like McKinsey and Gartner, digital ecosystems are on the verge of eclipsing traditional industry boundaries. As commerce becomes increasingly organized around interconnected sets of services, McKinsey predicts at least 12 distinctive and massive B2C and B2B ecosystems will emerge in just over five years, accounting for 30 percent of all global revenues, or about $60 trillion in revenue opportunities.

Clustered around addressing fundamental human and organizational needs, consumer ecosystems will likely include housing, health, and (physical and virtual) mobility. For business ecosystems, expect a B2B marketplace, offering tangible items such as machinery or equipment, and B2B services, comprised of accounting, legal and management services leveraging a digital cloud-based infrastructure and applications.

Although the ultimate shape and composition of B2C and B2B ecosystems will vary by country and region, the inevitability of ecosystems’ existence and the imperative for insurers to operate within this new structure remains the same.

New roles can mean new revenue

Insurers can elect to develop adaptable new value-added services to generate new revenue streams within ecosystems that are already emerging and among ecosystems yet to develop. Insurers may elect to step into significantly new roles and orchestrate their risk-management mini-ecosystems. An example might be an expanded role in cyber insurance that brings together cloud providers, cybersecurity experts, providers of anonymized customer data and others, to offer cyber-attack prevention and post-breach response services.

No matter which path you pursue, operating within ecosystems is dramatically different than today’s paradigm. Insurers will need to capture digital customer signals and data sources from multiple channels within and outside of a given ecosystem and then make the data actionable to invent and support better products and services. Similarly, products and services will need to demonstrate a far deeper level of customer intimacy to ensure you present the right offering at the right time. On the retention side, you’ll need mechanisms for interacting with customers far more often and with greater depth of understanding, than ever before.

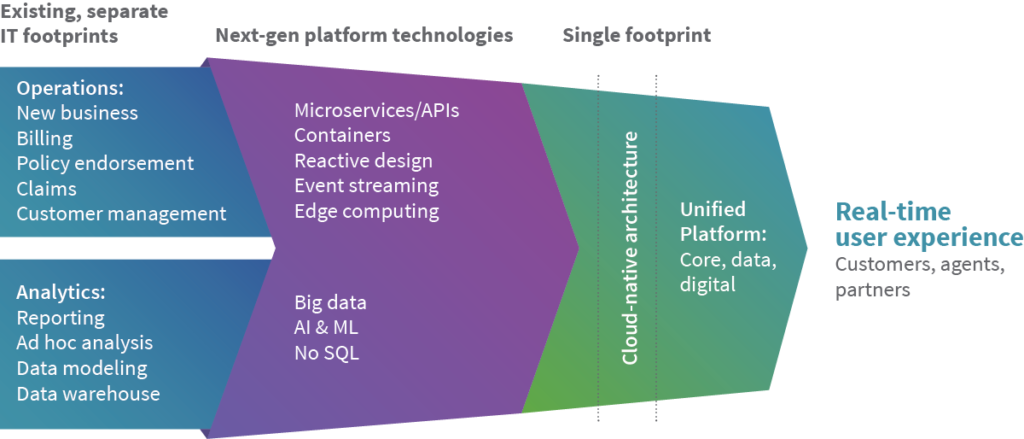

Connecting to and operating effectively within ecosystems requires a migration toward cloud-native technologies, including the microservices, containers, event-streaming, and APIs in next-generation insurance applications and platforms. Such cloud-native building blocks enable quickly plugging into, partnering and leveraging, available networks inside and across ecosystems and subgroups to capture ever-evolving opportunities while also breaking business capabilities down into smaller highly-scalable services that are quicker and easier to replace and upgrade.

Powering real-time user experiences requires unifying operations and analytics.

Competing in a market that is at once customer-centric and ecosystem-based requires not only meeting user’s real-time expectations but also the agility to evolve as new types of experiences and interactions arise rapidly. Whether it’s digital assistants like Alexa, health tracking wearables or emerging interest in augmented reality/virtual reality, successful insurers will have the capability to address whatever comes next.

This requires rethinking your models for operations and analytics. Until now, core, digital, and data platforms could be separate. However, in the new market paradigm, separate footprints introduce data transfer lags and gaps that are simply unacceptable. A unified tech platform is needed to support a platform business model that flourishes on real-time interaction while taking advantage of data-driven insights.

Moving from separate operations and analytics platform s to a unified platform supports real-time user experiences.

Further, traditional data warehouses limit the ability to support the larger, noisier and broader datasets needed for accomplishing the complex calculations that generate real-time, customer-centric experiences. For example, IoT data gathered from health wearables offer massive datasets for generating a better understanding of your policyholders and the risks you need to mitigate.

What’s more, scalability must also be addressed. With new types of analytics and skyrocketing data feeds, you must gain insights at scale for essential activities. This includes immediately identifying a fraudulent claim, uncovering an imminent risk or making a timely and unique offer to a policyholder.

Unifying operations and analytics with cloud-native architectures and cloud-based infrastructures address all of these challenges. Cloud innovations such as serverless computing drive out various types of latency to speed data flow, while simultaneously providing the capability to gather enormous amounts of information and then scale analytics to integrate complex, AI-enabled insights into every transaction.

In a next-gen unified platform, core processing and AI capabilities are inseparable components working in tandem with rules, transactions and workflow to make smarter insurance operations.

As you consider which partners can assist with achieving your business goals, be sure to evaluate their strategic alignment and path toward delivering cloud-native solutions. Your capability to operate nimbly and scalably in an ecosystem-centric market and infuse customer experiences with data-driven analytics will make the difference between staying competitive and getting left behind.

To learn more, download “Eight ways to power your digital transformation with a next-generation insurance platform in the cloud”.