Just weeks ago, we reached out to announce the general availability and completion of version 10 of EIS Suite™. That message focused on the features and advantages for Accident & Health insurers.

Today, we offer the same for Property & Casualty insurers.

After reviewing these new features for P&C insurers, I’m sure you’ll appreciate the value and breadth of functionality that we are delivering. Version 10 is the culmination of 12 months of effort from EIS Group employees from all corners of the globe. It demonstrates our continuing commitment to help insurance carriers innovate and operate like a tech company: fast, simple, and agile.

This year, we distributed 17 Agile functional and platform updates for both Accident & Health and Property & Casualty insurers, an accomplishment that we are exceedingly proud of. As you will see from the descriptions below, and from our substantial new product documentation, we enhanced the entire platform and all of our core modules in this version.

We look forward to a healthy and successful 2020 as we continue to transform both the Accident & Health and Property & Casualty insurance industries with our customer-centric, cloud-native coretech solutions.

On to version 11!

Digital Experience Platform and Persona-Based Apps

As part of our ongoing effort to improve the customer experience, our phenomenal EIS DXP™ UX/UI team has developed the EIS Design System Manager. This growing repository of configurable user interface (UI) components provides consistency, reusability, and productivity increases for insurers and insureds.

In this release, we have introduced several modular and configurable digital applications while laying the foundation for more to come. Apps for personas such as Billing Agent, Claims Agent, Customer Service Representative, and Customer Self-Service are currently available. These apps can easily be adapted to reflect a client’s vision of customer experience (CX) using configurable components and design themes. The focus on user experience puts functionality seamlessly at the service of the user’s goals without cluttering the workspace. It also accelerates training and increases productivity.

“Over three years, we’ve been enhancing DXP to support this notion of ‘persona,’” explains Fazi Zand, senior vice president of product management. “It knows who the user is, their usage pattern, what their optimized work components are, and what is the best path to results given the device they are using. If there are relevant rules for that persona, it applies them. DXP apps let the users engage in how they work with the systems, and DXP enables that by interfacing with the back-end systems.”

- CSR, Billing Agent, and Claims Agent are new persona-based applications that deliver excellent user experience for customer service, billing, and claims operations

- For the Customer persona, for both consumers and business customers, DXP provides secure web and mobile apps with a full complement of functionality where excellent customer experience is crucial to customer retention and insurers’ success

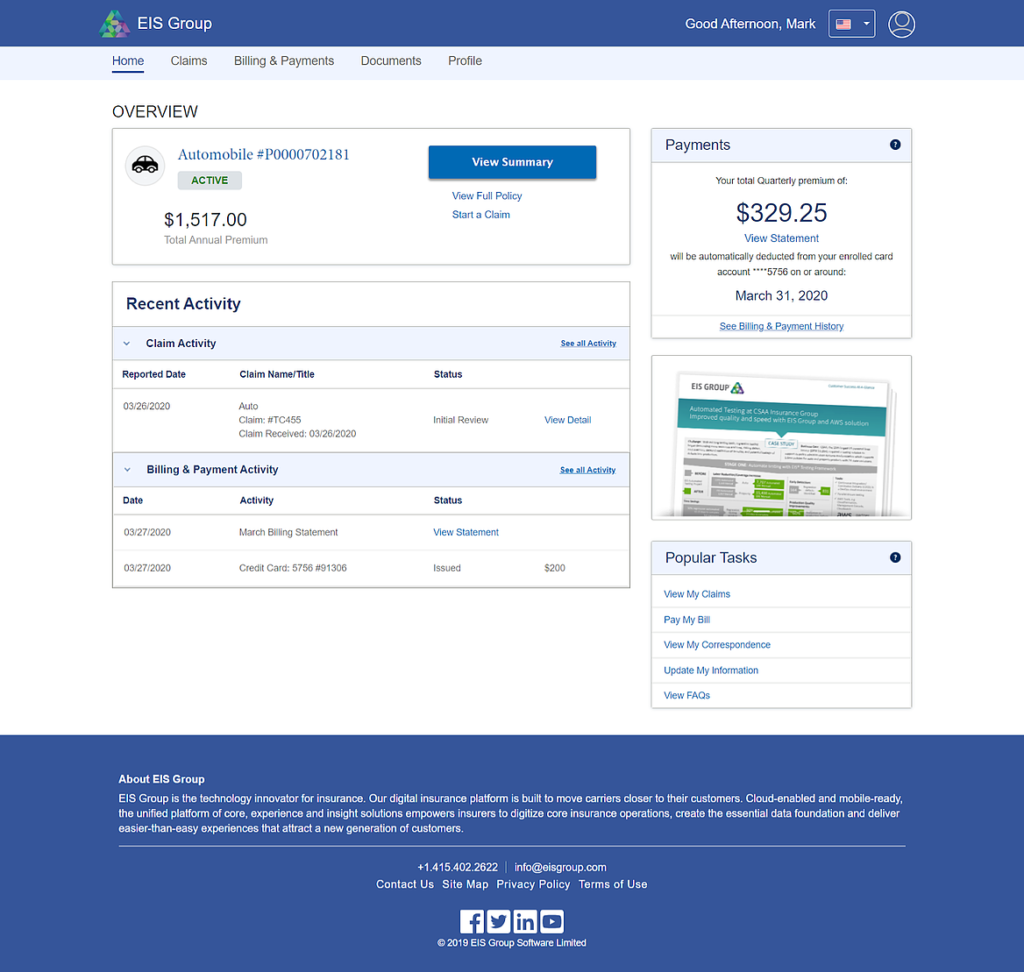

Above: Fully functional user interface for member self-service dashboard

“With the REST services and the APIs, it’s a very rich customer experience,” says Rita Iorfida, vice president of product strategy. “It’s also great for any of the other omnichannel devices. Once you’ve got that DXP API exposed, you can use it in a mobile app, a portal, customer portals, agent portals, employer portals, or anywhere.”

PolicyCore

PolicyCore’s Usage-Based Insurance (UBI) product has been in production for years, but version 10 is full of new capabilities that make it possible to support more innovative business models. “We took our lessons learned from our clients and adapted the product to accommodate their immediate needs, as well as their expectations for the future,” says Beverly Reese Dorcy, EIS Group’s product strategy executive for P&C PolicyCore®.

Our UBI functionality supports usage-based discounts by applying behavior data from the prior month to derive the premium discount applicable for the next month’s premium. Now UBI discounting can be applied to any insurance product from any internet-of-things data feed. “At the integration point, we receive and apply the scores to generate a discount,” Dorcy says. “Then it creates the UBI transaction and applies it to the premium for the upcoming period.”

The enhancements also expand customer opportunities for UBI products and allow manual or automated discounting, which reduces out-of-sequence processing for greater efficiency and ease of use. In addition, streamlined UBI transaction history allows for a better user experience while reducing the overall impact on insurers’ systems and data storage.

Additional Benefits

- Simplified and accelerated processing of bundled quotes

- Improved consistency and security for the Book of Business filter

- The ability to rollback over any transaction, which eliminates multiple manual processing steps

- Support for GDPR, which implements the “Right to be Forgotten” in the European Union and elsewhere

- Introduces the ability to calculate earned premium on a daily rate basis expanding options for determining earned premium

ClaimCore

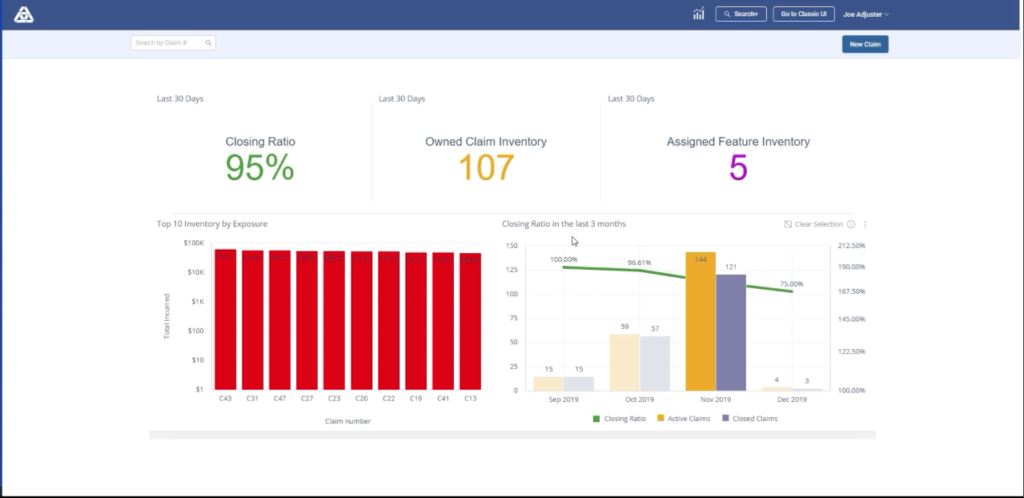

The most apparent improvement to ClaimCore® is the new Adjustor Application Dashboard. “The Adjustor Dashboard is a slick new interactive user interface that offers important information at a glance to users and management to help them prioritize and execute on the claims that matter most,” says Jim Eva, product strategy executive. “We also made many subtle enhancements to the user experience and automation. Cumulatively, they offer a substantial opportunity to improve efficiency and effectiveness for insurers who choose the upgrade.”

The new Adjuster Application Dashboard landing page significantly improves the user experience by offering a graphical representation of a user’s productivity, including:

- Closing Ratio, Owned Claim Inventory, and Assigned Feature Inventory within the last 30 days

- Top 10 Inventory by Exposure, which allows adjusters to quickly see their most financially impactful claims

- Closing Ratio in the last three months, which displays for the user and management team the ratio of active to closed claims over the last three months, providing a more comprehensive view of ongoing performance and any potential trends

Additional Benefits

- First Notice of Loss “Add Party” functionality now is more visible and accessible and allows users first to add party, then add coverage, and then the feature

- Related documents, tasks, notes, photos, subrogation, and recovery allocations are readily available, and Notes and Payments are easily accessible on any tab, reducing the amount of toggling for the user

BillingCore

Version 10 of BillingCore® is loaded with new functionality and value for users and insurers, especially in regards to the user experience. “We’re always trying to make things more transparent,” says Rita Iorfida, vice president of product strategy. Version 10 of BillingCore vastly simplifies the user interface and streamlines processing efficiency, she adds. “The best example is our new ‘true shopping cart experience,’ which lets users bundle quotes for multiple products through the purchase process to a single account and invoice process.”

Above: The new “true shopping cart experience” lets users bundle quotes for multiple products

Additional Benefits

- Users now can change bill types from Agency Bill to Direct or Mortgagee, and vice versa, and manage billing balances as well as commissions balances

- The ability to expand and collapse the consolidated view of Billing Accounts simplifies navigation, improving the user experience as well as productivity

- The ability to upload a list of payments in a CSV file format through batch processing and automatically allocate payments

- Support for consolidated statement processing, which brings together multiple invoices and invoice types for the same customer