The movement of the benefits insurance industry toward a more customer-centric approach has undoubtedly been jarring to some carriers.

To be clear, insurers do understand the full-on B2B approach to benefits is out of step with employees’ interests, and that personalized experiences help carriers match the progression of employees’ lives and boost customer loyalty.

However, carriers have spent a long time focusing on true group products, with little to no end-customer engagement — let alone personalization. With a group-centric model entrenched into the core of their business, doing an immediate about-face to a customer-centric approach simply wasn’t feasible.

Embrace agility and innovation

Insurers that can adapt quickly — and proactively — when customer expectations change will always be better situated than their non-agile counterparts.

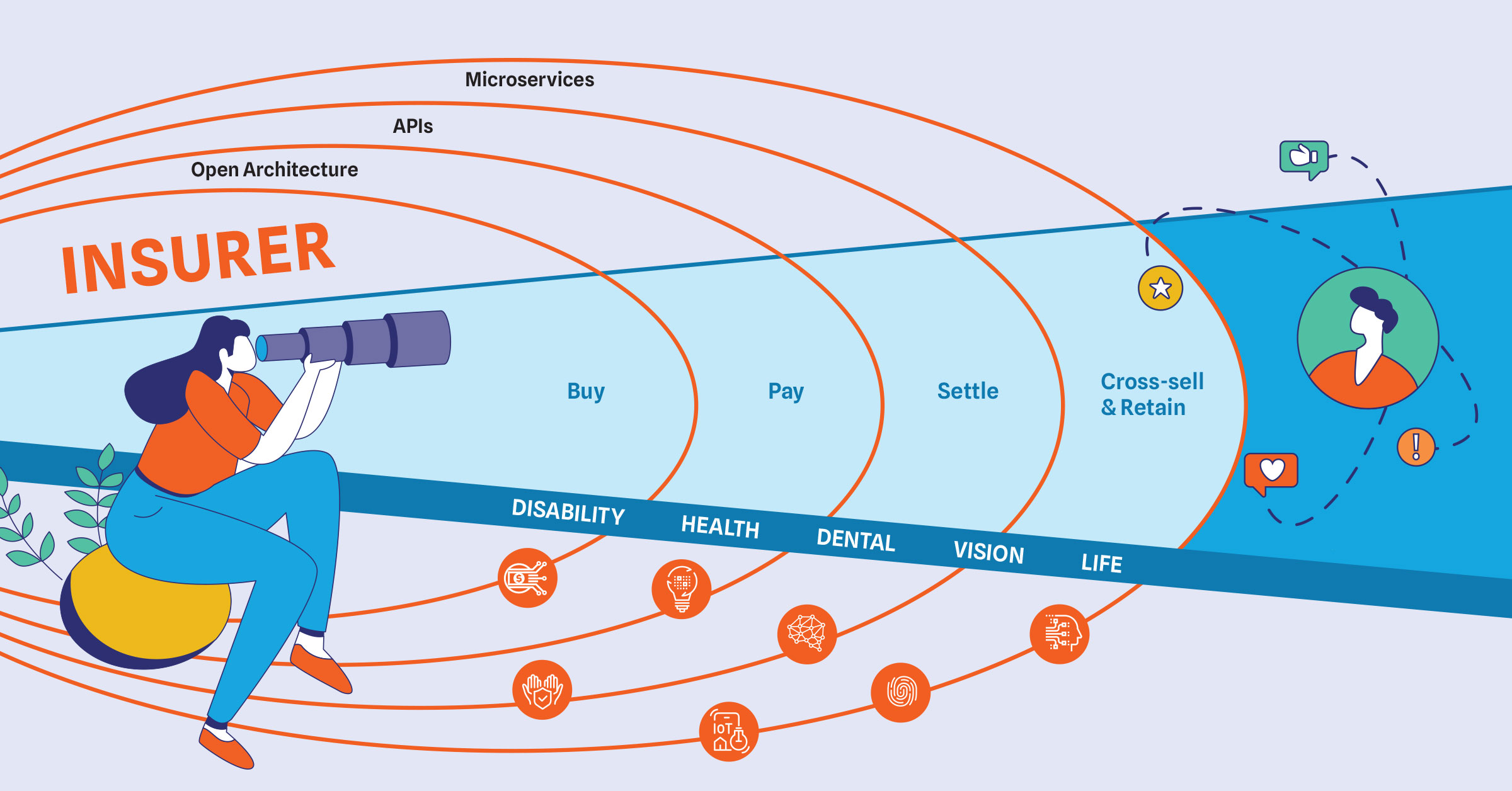

Traditionally, benefits carriers siloed data by category (policy, billing, claims, and so on.). But enabling personalized experiences requires data that can flow freely through an insurer’s infrastructure. As just one example, automated claims processing needs ready access to policy data to know coverage and payout details and can then automate (and personalize) these processes, making end-customers’ side of the claims experience simpler, more efficient, and more satisfying.

Innovation is another key piece of this puzzle. This takes many forms, ranging from new partnerships with forward-thinking insurtechs to adopting technologies like AI or machine learning. An ecosystem approach that facilitates access to a wide spectrum of tech capabilities, coupled with an infrastructure capable of supporting them, creates an incredible customer experience.

Avoid an outdated transformation approach

In the past, benefits transformations often tunnel-visioned on operational needs: reducing costs, streamlining processes, and so on. This “inside-out” approach might’ve been reasonable when insurance sales were group-focused, but it’s not viable in an era where personalization is critical. Instead, an “outside-in” approach where carriers transform for the good of the ecosystem in which they operate — and all customers involved — makes more sense for modern benefits insurance. This shift must be driven by a comprehensive understanding of customer demands, needs, and expectations.

Leverage data effectively for optimal customer-centricity

Benefits carriers have massive stores of customer data available to use. As insurers collaborate with insurtechs and other partner organizations to form ecosystems, their data volume expands exponentially — and it can be one of their greatest assets.

Concrete customer insights — into behavior, needs, policy usage, satisfaction, and more — can majorly benefit insurers’ transformations. Utilizing this data effectively, as part of ongoing operations, helps carriers deliver personalized experiences for insurance customers and offer them the most relevant services for the future.

Insurers that leverage cutting-edge technologies in their core system architecture can enable this type of customer-centric, data-driven strategy. Carriers thus ensure their customers (and end users) never get lost in the shuffle of segmented group policies. At the same time, the increased customer-centricity and digital connectivity that result from this tech-supported strategy naturally contribute to higher operational efficiency — and allowing insurers to pursue new business models and partnerships.

Support a customer-centric transformation with data-fluid coretech

Legacy-architected core technologies can’t efficiently process enterprise-scale customer data and facilitate the integrations necessary to create a truly customer-centric benefits insurance experience.

Leading-edge coretech solutions like the cloud-native EIS Suite provide the critical support that today’s benefits insurers need to transform in a customer-centric and cost-effective way. The solution’s cloud-based scalability, microservices-based architecture, and vast library of open APIs allow carriers to easily integrate with insurtechs and other third-party partners.

Become a truly human-centric insurer

At times, the group-focused, strictly B2B business model for benefits insurance seems so pervasive that some of us at EIS call it “the sea of sameness.” But ambitious insurers don’t have to settle for that.

Our eBook, “The Ambitious Insurer’s Guide to Human Centricity,” provides a clear roadmap for breaking free of benefits carriers’ old bad habits. Download it to learn how to cast aside the commoditization of benefits insurance and instead enable an ecosystem approach that makes the benefits experience relevant, efficient, and truly human-centric.