3 Tech Capabilities for Protection Insurers to Achieve Their Full Potential

There’s a growing capability gap between truly modern coretech and “modern” legacy platforms, driving a corresponding success gap between insurers who use either system.

Despite their name, “modern” legacy platforms offer limited capabilities that don’t measure up to customers’ expectations. Because they lack proper tooling and deployability, these monolithic systems hold protection insurers back from keeping pace with industry changes and reaching their full potential.

With the right core system, carriers can achieve the agility, personalisation, and scalability they need to remain competitive.

Truly modern coretech has plenty of cutting-edge capabilities to boast about, but this post focuses on three especially game-changing ones: event-driven architecture, a single platform for individual and group policies, and agility to handle speed of change.

1. Event-Driven Architecture

Monolithic systems may be able to send out annual notices with links to coverage information and premium prices, but they can’t serve up the automations and personalisations consumers need as they navigate life changes.

Conversely, the architecture of EIS Suite is event-driven and centered around the customer as the main record type. This seemingly simple difference in setup makes for drastic improvements in customer experiences.

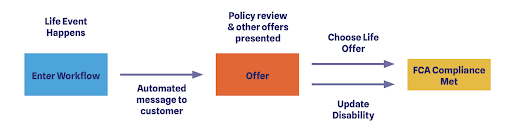

.

Event-driven architecture is a model that enables companies to detect events — think significant changes or business moments — and trigger actions in response to them, in real time. Rather than send out cold, annual notices, an event-driven platform can act nimbly on data that’s newly entered or picked up by third-party suppliers. For instance, if an income protection customer gets married, has a child, or buys a house, your system can detect that life event and automate a personalised communication with a congratulatory message and a special offer for a higher coverage amount. Though hands-off, event-driven architecture’s personalisation and timeliness enhances customer experiences.

2. Individual and Group Policies on a Single Platform

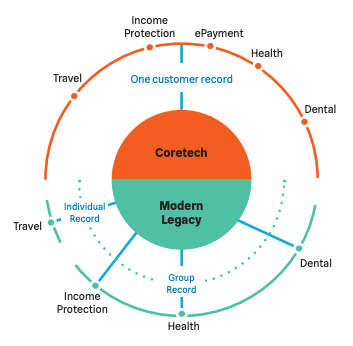

Outdated platforms were built with limited mindsets around architecture for protection insurers. As a result, most core systems can either only handle group records or individual records — not both.

More employers are expanding group protection packages to include a multitude of standard protection policies, along with new products that may be fully employee-paid. With old systems, this would be difficult to offer.

A customer-centric architecture, on the other hand, focuses policies around customers instead of the other way around. This allows insurers and customers to work within a single platform, where they can select an individual’s protection products and easily manage the group versus individual dynamics, whether in policy or billing.

3. Agility to Handle Speed of Change

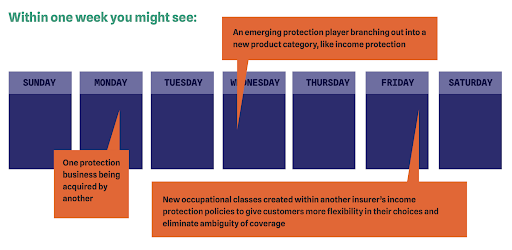

Consumer demands aren’t the only things evolving in the protection market — structural business changes are just as present.

Having the agility to pursue strategic initiatives comes down to selecting the right technological back-bone — a choice that could make or break any insurer’s success.

However, legacy platforms hold insurers back from keeping pace with these changes.

The right technology will empower you with low-code or no-code tooling, which frees you to make your desired changes without any hand-holding from your vendor. It’ll also have an architecture with strong product governance built in, ensuring your products are developed, managed, and retired in a manner that maximizes benefits while minimizing potential pitfalls.

Better yet, a microservices setup and open APIs provide the interoperability required to have a truly open and connected ecosystem that can integrate with HR administration software, payroll, and absence management platforms.

Gain the Ultimate Capability Trilogy and Then Some

The growing capability gap between protection insurers who have coretech like EIS Suite and ones with modern legacy platforms isn’t going to bridge itself.

Choosing a core platform like EIS helps you achieve agility, personalisation, and scalability — all things you need to maintain a competitive edge.

Want to know more about what to look for in a core system? Sign up for our bite-size newsletter to learn how to nitpick the best one for your business.