See how EIS enabled a century-old life insurer to launch new, modernized products into group benefits ASAP with EIS OneSuite™.

See how EIS enabled a century-old life insurer to launch new, modernized products into group benefits ASAP with EIS OneSuite™.

Leave management and leave claims don’t have to be painful. See how industry experts advise insurers to ditch what doesn’t work to put people first.

See how EIS uses secure, ISO 42001-compliant AI to boost productivity, improve claims, quoting, and core system performance for insurers.

Use our no-fluff, outcome-focused scoresheet to see if your core system drives growth or slows you down with outdated tech and bloated processes.

What does it really take to build a greenfield insurance business? Pacific Life and Wellfleet share what worked and what didn’t from their own experiences.

Brokers are paying more & more attention to carriers’ tech functionality to make HR’s life easier. Here’s how to deliver on what they’re looking for.

The 2025 State of Leave and Accommodations Report had some interesting insights. Here’s how group benefits insurers can step in to help.

Wellfleet Insurance, a leader in health and accident benefit plans, recently partnered with EIS to revolutionize the voluntary benefits market. Their goal? To create a seamless, digital-first experience for employers and employees alike.

Policy-centric insurance models prioritize policy sales over customer experience, but this approach can lead to several issues that negatively impact customer satisfaction and business growth.

Learn how event-driven architecture can streamline claims processing and improve customer satisfaction for workplace benefits insurers.

Seamless data integration and transfer using APIs is the key to improving the user experience for group benefits insurers.

Discover how combining analytics and generative AI can help benefits carriers unlock valuable insights and streamline operations from customer service to fraud detection.

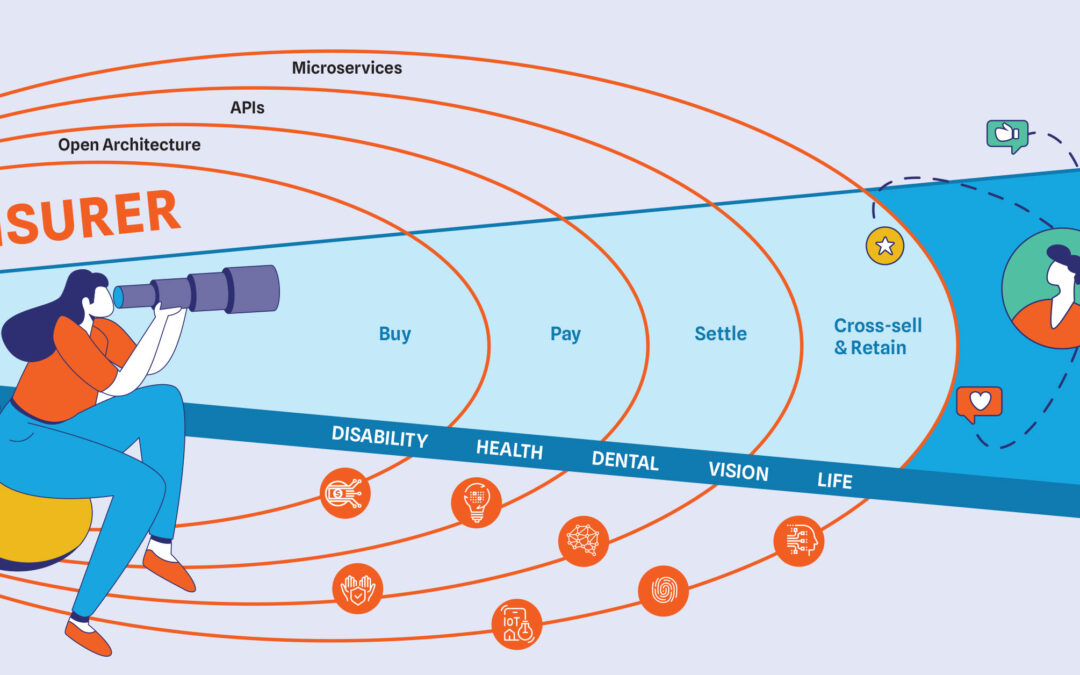

Carriers have spent a long time focusing on true group products, with little to no end-customer engagement — let alone personalization. With a group-centric model entrenched into the core of their business, doing an immediate about-face to a customer-centric approach simply wasn’t feasible.

The recent shifts in employee benefits — and the resulting demand on benefit providers’ technology capabilities — means benefits insurers must make fast-paced tech upgrades to keep up. Without the right underlying technology, these enhancements can be difficult to implement, deploy, and manage.

Ambition is going to be vital during insurance’s next stage of evolution. Today ambitious insurers are building customer experience as a way to differentiate themselves, expanding products and partnering across an ever-expanding ecosystem to bring new value to customers’ lives.

Tony Grosso explores how the insurance industry has changed over the past decade and how technology will either be the super power for your growth or your achilles heal.

In 2022, data is the lifeblood of your business decisions. And while there’s no shortage of data in the insurance industry — think: claims data,...

Now more than ever, your customers’ employees are looking for a digital open enrollment experience for benefits insurance. They’re used to shopping...

The COVID-19 pandemic heightened awareness around managing employee leaves of absence and associated regulations. In fact, according to a recent...

See how EIS enabled a century-old life insurer to launch new, modernized products into group benefits ASAP with EIS OneSuite™.

Leave management and leave claims don’t have to be painful. See how industry experts advise insurers to ditch what doesn’t work to put people first.

See how EIS uses secure, ISO 42001-compliant AI to boost productivity, improve claims, quoting, and core system performance for insurers.

Use our no-fluff, outcome-focused scoresheet to see if your core system drives growth or slows you down with outdated tech and bloated processes.

What does it really take to build a greenfield insurance business? Pacific Life and Wellfleet share what worked and what didn’t from their own experiences.

Brokers are paying more & more attention to carriers’ tech functionality to make HR’s life easier. Here’s how to deliver on what they’re looking for.

The 2025 State of Leave and Accommodations Report had some interesting insights. Here’s how group benefits insurers can step in to help.

Wellfleet Insurance, a leader in health and accident benefit plans, recently partnered with EIS to revolutionize the voluntary benefits market. Their goal? To create a seamless, digital-first experience for employers and employees alike.

Policy-centric insurance models prioritize policy sales over customer experience, but this approach can lead to several issues that negatively impact customer satisfaction and business growth.

Learn how event-driven architecture can streamline claims processing and improve customer satisfaction for workplace benefits insurers.

Seamless data integration and transfer using APIs is the key to improving the user experience for group benefits insurers.

Discover how combining analytics and generative AI can help benefits carriers unlock valuable insights and streamline operations from customer service to fraud detection.

Carriers have spent a long time focusing on true group products, with little to no end-customer engagement — let alone personalization. With a group-centric model entrenched into the core of their business, doing an immediate about-face to a customer-centric approach simply wasn’t feasible.

The recent shifts in employee benefits — and the resulting demand on benefit providers’ technology capabilities — means benefits insurers must make fast-paced tech upgrades to keep up. Without the right underlying technology, these enhancements can be difficult to implement, deploy, and manage.

Ambition is going to be vital during insurance’s next stage of evolution. Today ambitious insurers are building customer experience as a way to differentiate themselves, expanding products and partnering across an ever-expanding ecosystem to bring new value to customers’ lives.

Tony Grosso explores how the insurance industry has changed over the past decade and how technology will either be the super power for your growth or your achilles heal.

In 2022, data is the lifeblood of your business decisions. And while there’s no shortage of data in the insurance industry — think: claims data,...

Now more than ever, your customers’ employees are looking for a digital open enrollment experience for benefits insurance. They’re used to shopping...

The COVID-19 pandemic heightened awareness around managing employee leaves of absence and associated regulations. In fact, according to a recent...