Industry Insights

Latest posts

The Devil is in the (Data) Details: Unleashing Future-Proof Insurance via Customer-Centric Data Management

Learn how insurers can use customer-centric data management to improve customer experience, operational efficiency, and leverage AI for better outcomes.

Tokio Marine & Nichido Fire’s Triumph: A Wild Success Story in Claims Revolution

Tokio Marine & Nichido Fire Insurance transformed its claims process using EIS ClaimSmart, achieving millions in annual savings, happier customers, and reduced fraud. A must-read for insurers seeking innovation and excellence!

New Product Alert! ClaimSmart Launches a New Era of Data-Driven Claims Efficiency & Personalization with AI and ML

Learn how ClaimSmart, an AI-powered cloud solution, can revolutionize claims processing and enhance customer experiences for insurers.

Stay ahead with the latest insights right in your inbox:

Keep reading

Are You Ready for the Next Wave of Consumer Duty?

The next deadline for the FCA’s Consumer Duty regulations is coming up in July, and for many insurers, it’ll be more important than the first.

2024 Insurance Outlook: A Digitally Resilient Future

From AI integration to blockchain adoption, this blog explores 10 key trends shaping the insurance industry in 2024 and beyond.

4 Protection Insurers Slashing Costs & Saving Time With EIS Suite

See what other protection carriers have accomplished with EIS Suite: launching products quickly, decreasing operations time, and improving customer experience.

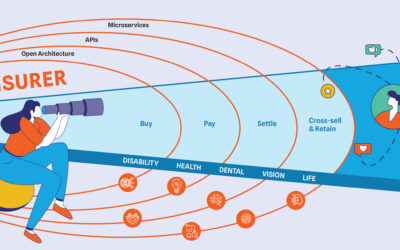

Why Combine Group & Individual Policies Onto a Single Platform?

By consolidating group and individual policies into one platform, insurers can provide simpler, streamlined user experiences.

How Event-Driven Architecture Benefits Protection Insurers & Their Customers

From increasing personalisation to improving customer experience, this event-driven architecture helps insurers increase & automate customer retention.

How Protection Insurers Can Opt Out of a Price-Driven Market & Still Win Business

Though protection insurance is increasingly price-driven, insurers don’t necessarily have to race their competitors to the bottom.

Achieving Future-Proof Agility Isn’t as Complex as It Seems

Though migration can be a complex undertaking for insurers, they have promising platform options to consider.

Achieve Customer Centricity & FCA Compliance By Solving for Dual System Operations

As protection insurance becomes more customer driven, the lack of support for dual system operations is especially ripe for a solution.

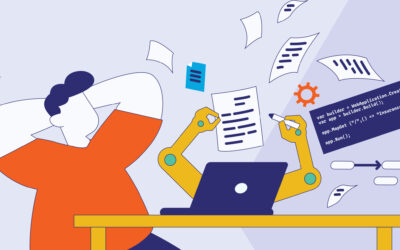

The Digitisation & Automation of Everything, Even Insurance

Customer expectations are at an all-time high. Learn how your tech stack can rise to — and exceed — these standards by going truly digital.

2023 Gratitude: Another Year of Customer Experience Excellence in Insurance

Discover the innovative customer experience initiatives insurers are taking to make insurance better for everyone, as well as individual stories of gratitude in the face of adversity.

EIS Joins GRiD, UK’s Group Risk Development

In line with our commitment to serving ambitious insurers all over the globe, we’re thrilled to announce we’re now members of GRiD (Group Risk Development) in the UK.

Greater Awareness & Demand for Protection Products

Get the comprehensive overview of the protection insurance industry, including emerging technologies and trends, to create the comprehensive protection package your employees need.

FCA Regulations Aren’t a Zero-Sum Game for Protection Insurers

Discover the many benefits of Financial Conduct Authority (FCA) regulations for protection insurers, and learn practical tips on how to get the most out of your efforts to comply.

Creepy & Kooky Genius: How Would the Addams Family Change Insurance?

Discover how the Addams family could revolutionize insurance, from Gomez as CFO to Wednesday as Head of Fraud Investigation to Thing as Automation Enabler.

Protection’s Big Business Opportunity Amongst Regulatory Changes

Get an in-depth overview of the opportunities that protection insurance presents in today’s rapidly changing market, and discover how insurers can use technology to their advantage.

Coretech Lessons From ‘Frasier’ – Don’t Know What to do With Your Tossed Salads and Scrambled Core Systems?

It’s official: one of TV’s most-awarded shows is coming back after almost 20 years. And while it might technically not have anything to do with insurance, we can’t help but see some incredible connections between the life of Frasier Crane and the evolution of insurance technology.

Get Better Benefits Insights When You Combine Analytics and Generative AI

Discover how combining analytics and generative AI can help benefits carriers unlock valuable insights and streamline operations from customer service to fraud detection.

Revolutionizing Absence Management With an Ecosystem Approach

Numerous employers have had difficulty managing the post-COVID increase in leave requests, due to sheer volume as well as varying (and frequently changing) state-by-state regulations. Without the digital insurance ecosystem approach — and the access to cutting-edge services and technologies it facilitates — truly revolutionary absence management is easier said than done.

The About-Face From Group-Centricity to Customer-Centricity: The Pursuit of Better Transformation in Benefits Insurance

Carriers have spent a long time focusing on true group products, with little to no end-customer engagement — let alone personalization. With a group-centric model entrenched into the core of their business, doing an immediate about-face to a customer-centric approach simply wasn’t feasible.

The AI Surge in Insurance: What’s the Real Story?

To put it lightly, AI, machine learning, generative AI, and language learning models (LLM) have caused a storm in the business market – including in insurance. It’s left insurers grappling with some pretty big questions. Let’s navigate the noise and pinpoint the real story of AI in insurance today.

5 Factors Affecting System Modernization in the Benefits Market

The recent shifts in employee benefits — and the resulting demand on benefit providers’ technology capabilities — means benefits insurers must make fast-paced tech upgrades to keep up. Without the right underlying technology, these enhancements can be difficult to implement, deploy, and manage.

The Winner & Finalists of the 2023 Ambitious Insurer Awards – North America

After hosting the inaugural Ambitious Insurer Awards at ITI Europe, we couldn’t wait to do the same at ITI in New York. The submissions were fascinating, but ultimately 10 were chosen as finalists, and our panel of judges selected one as the winner.

Inflation Mitigation: How Insurers can Protect Themselves Against Price Pressure

As insurers battle rising claims volume and the costs of servicing those claims, the industry must find ways to protect itself against price pressure or see its profits dwindle further. Being adaptive is going to be the single biggest success factor for the industry moving forward. However, that change must go further than moving established processes online.

Reduce Insurance Fraud: Why Insurers Need Machine Learning

Fraud detection in insurance is an arms race. Fraudsters are creating new ways to push through fraudulent claims every day, and insurers are trying desperately to identify and block them the instant they crop up.

Why Ambition is Essential to the Future of Insurance

Ambition is going to be vital during insurance’s next stage of evolution. Today ambitious insurers are building customer experience as a way to differentiate themselves, expanding products and partnering across an ever-expanding ecosystem to bring new value to customers’ lives.