EIS’s award-winning claims automation solutions, ClaimCore and ClaimGuard, are revolutionizing the insurance industry with AI-driven efficiency and fraud detection.

EIS’s award-winning claims automation solutions, ClaimCore and ClaimGuard, are revolutionizing the insurance industry with AI-driven efficiency and fraud detection.

Learn how the cloud-agnostic flexibility of EIS Platform can provide insurance companies with a safety net against system outages and data breaches.

Learn how to navigate the complexities of cloud-based insurance operations to ensure a successful transition for your company.

The next deadline for the FCA’s Consumer Duty regulations is coming up in July, and for many insurers, it’ll be more important than the first.

From AI integration to blockchain adoption, this blog explores 10 key trends shaping the insurance industry in 2024 and beyond.

See what other protection carriers have accomplished with EIS Suite: launching products quickly, decreasing operations time, and improving customer experience.

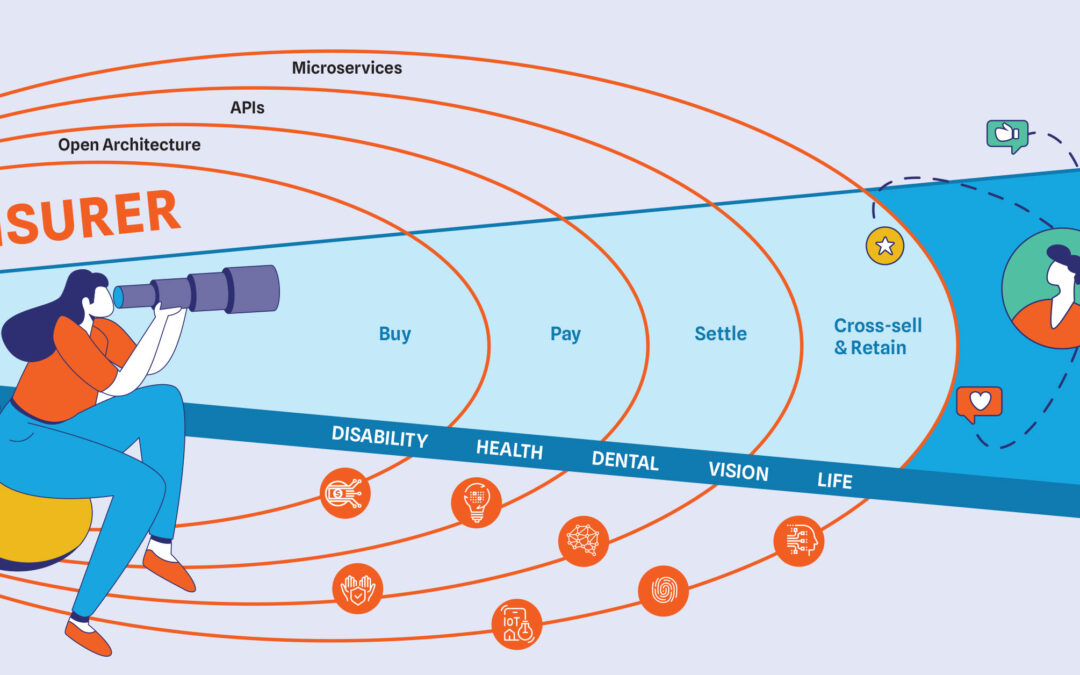

By consolidating group and individual policies into one platform, insurers can provide simpler, streamlined user experiences.

From increasing personalisation to improving customer experience, this event-driven architecture helps insurers increase & automate customer retention.

Though protection insurance is increasingly price-driven, insurers don’t necessarily have to race their competitors to the bottom.

Though migration can be a complex undertaking for insurers, they have promising platform options to consider.

As protection insurance becomes more customer driven, the lack of support for dual system operations is especially ripe for a solution.

Customer expectations are at an all-time high. Learn how your tech stack can rise to — and exceed — these standards by going truly digital.

Discover how the Addams family could revolutionize insurance, from Gomez as CFO to Wednesday as Head of Fraud Investigation to Thing as Automation Enabler.

It’s official: one of TV’s most-awarded shows is coming back after almost 20 years. And while it might technically not have anything to do with insurance, we can’t help but see some incredible connections between the life of Frasier Crane and the evolution of insurance technology.

Discover how combining analytics and generative AI can help benefits carriers unlock valuable insights and streamline operations from customer service to fraud detection.

Numerous employers have had difficulty managing the post-COVID increase in leave requests, due to sheer volume as well as varying (and frequently changing) state-by-state regulations. Without the digital insurance ecosystem approach — and the access to cutting-edge services and technologies it facilitates — truly revolutionary absence management is easier said than done.

Carriers have spent a long time focusing on true group products, with little to no end-customer engagement — let alone personalization. With a group-centric model entrenched into the core of their business, doing an immediate about-face to a customer-centric approach simply wasn’t feasible.

To put it lightly, AI, machine learning, generative AI, and language learning models (LLM) have caused a storm in the business market – including in insurance. It’s left insurers grappling with some pretty big questions. Let’s navigate the noise and pinpoint the real story of AI in insurance today.

The recent shifts in employee benefits — and the resulting demand on benefit providers’ technology capabilities — means benefits insurers must make fast-paced tech upgrades to keep up. Without the right underlying technology, these enhancements can be difficult to implement, deploy, and manage.

After hosting the inaugural Ambitious Insurer Awards at ITI Europe, we couldn’t wait to do the same at ITI in New York. The submissions were fascinating, but ultimately 10 were chosen as finalists, and our panel of judges selected one as the winner.

As insurers battle rising claims volume and the costs of servicing those claims, the industry must find ways to protect itself against price pressure or see its profits dwindle further. Being adaptive is going to be the single biggest success factor for the industry moving forward. However, that change must go further than moving established processes online.

Fraud detection in insurance is an arms race. Fraudsters are creating new ways to push through fraudulent claims every day, and insurers are trying desperately to identify and block them the instant they crop up.

Ambition is going to be vital during insurance’s next stage of evolution. Today ambitious insurers are building customer experience as a way to differentiate themselves, expanding products and partnering across an ever-expanding ecosystem to bring new value to customers’ lives.

Tony Grosso explores how the insurance industry has changed over the past decade and how technology will either be the super power for your growth or your achilles heal.

How insurers leverage human centricity to build a personalized insurance customer experience that meets today’s market demands.

EIS’s award-winning claims automation solutions, ClaimCore and ClaimGuard, are revolutionizing the insurance industry with AI-driven efficiency and fraud detection.

Learn how the cloud-agnostic flexibility of EIS Platform can provide insurance companies with a safety net against system outages and data breaches.

Learn how to navigate the complexities of cloud-based insurance operations to ensure a successful transition for your company.

The next deadline for the FCA’s Consumer Duty regulations is coming up in July, and for many insurers, it’ll be more important than the first.

From AI integration to blockchain adoption, this blog explores 10 key trends shaping the insurance industry in 2024 and beyond.

See what other protection carriers have accomplished with EIS Suite: launching products quickly, decreasing operations time, and improving customer experience.

By consolidating group and individual policies into one platform, insurers can provide simpler, streamlined user experiences.

From increasing personalisation to improving customer experience, this event-driven architecture helps insurers increase & automate customer retention.

Though protection insurance is increasingly price-driven, insurers don’t necessarily have to race their competitors to the bottom.

Though migration can be a complex undertaking for insurers, they have promising platform options to consider.

As protection insurance becomes more customer driven, the lack of support for dual system operations is especially ripe for a solution.

Customer expectations are at an all-time high. Learn how your tech stack can rise to — and exceed — these standards by going truly digital.

Discover how the Addams family could revolutionize insurance, from Gomez as CFO to Wednesday as Head of Fraud Investigation to Thing as Automation Enabler.

It’s official: one of TV’s most-awarded shows is coming back after almost 20 years. And while it might technically not have anything to do with insurance, we can’t help but see some incredible connections between the life of Frasier Crane and the evolution of insurance technology.

Discover how combining analytics and generative AI can help benefits carriers unlock valuable insights and streamline operations from customer service to fraud detection.

Numerous employers have had difficulty managing the post-COVID increase in leave requests, due to sheer volume as well as varying (and frequently changing) state-by-state regulations. Without the digital insurance ecosystem approach — and the access to cutting-edge services and technologies it facilitates — truly revolutionary absence management is easier said than done.

Carriers have spent a long time focusing on true group products, with little to no end-customer engagement — let alone personalization. With a group-centric model entrenched into the core of their business, doing an immediate about-face to a customer-centric approach simply wasn’t feasible.

To put it lightly, AI, machine learning, generative AI, and language learning models (LLM) have caused a storm in the business market – including in insurance. It’s left insurers grappling with some pretty big questions. Let’s navigate the noise and pinpoint the real story of AI in insurance today.

The recent shifts in employee benefits — and the resulting demand on benefit providers’ technology capabilities — means benefits insurers must make fast-paced tech upgrades to keep up. Without the right underlying technology, these enhancements can be difficult to implement, deploy, and manage.

After hosting the inaugural Ambitious Insurer Awards at ITI Europe, we couldn’t wait to do the same at ITI in New York. The submissions were fascinating, but ultimately 10 were chosen as finalists, and our panel of judges selected one as the winner.

As insurers battle rising claims volume and the costs of servicing those claims, the industry must find ways to protect itself against price pressure or see its profits dwindle further. Being adaptive is going to be the single biggest success factor for the industry moving forward. However, that change must go further than moving established processes online.

Fraud detection in insurance is an arms race. Fraudsters are creating new ways to push through fraudulent claims every day, and insurers are trying desperately to identify and block them the instant they crop up.

Ambition is going to be vital during insurance’s next stage of evolution. Today ambitious insurers are building customer experience as a way to differentiate themselves, expanding products and partnering across an ever-expanding ecosystem to bring new value to customers’ lives.

Tony Grosso explores how the insurance industry has changed over the past decade and how technology will either be the super power for your growth or your achilles heal.

How insurers leverage human centricity to build a personalized insurance customer experience that meets today’s market demands.