Learn how insurers can use customer-centric data management to improve customer experience, operational efficiency, and leverage AI for better outcomes.

Learn how insurers can use customer-centric data management to improve customer experience, operational efficiency, and leverage AI for better outcomes.

See what other protection carriers have accomplished with EIS Suite: launching products quickly, decreasing operations time, and improving customer experience.

By consolidating group and individual policies into one platform, insurers can provide simpler, streamlined user experiences.

From increasing personalisation to improving customer experience, this event-driven architecture helps insurers increase & automate customer retention.

Though protection insurance is increasingly price-driven, insurers don’t necessarily have to race their competitors to the bottom.

Though migration can be a complex undertaking for insurers, they have promising platform options to consider.

As protection insurance becomes more customer driven, the lack of support for dual system operations is especially ripe for a solution.

Customer expectations are at an all-time high. Learn how your tech stack can rise to — and exceed — these standards by going truly digital.

Carriers have spent a long time focusing on true group products, with little to no end-customer engagement — let alone personalization. With a group-centric model entrenched into the core of their business, doing an immediate about-face to a customer-centric approach simply wasn’t feasible.

To put it lightly, AI, machine learning, generative AI, and language learning models (LLM) have caused a storm in the business market – including in insurance. It’s left insurers grappling with some pretty big questions. Let’s navigate the noise and pinpoint the real story of AI in insurance today.

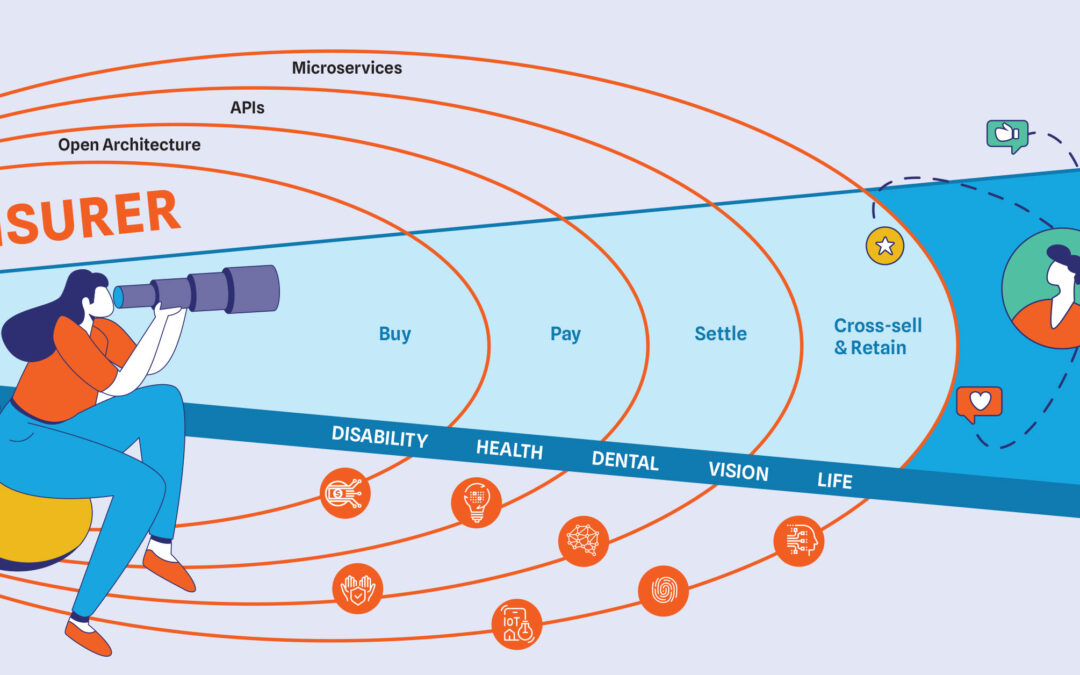

Ambition is going to be vital during insurance’s next stage of evolution. Today ambitious insurers are building customer experience as a way to differentiate themselves, expanding products and partnering across an ever-expanding ecosystem to bring new value to customers’ lives.

How insurers leverage human centricity to build a personalized insurance customer experience that meets today’s market demands.

For insurers, balancing premium, investment and income against exposure has always been a challenge, adding CX to the mix raises the difficulty.

How successful underwriters are adapting to new data, AI, and ecosystems to harmonize data and forecast models, identify fraud, and optimize performance.

Four artificial intelligence and machine learning opportunities that will reshape insurance.

The rise of intelligent automation, APIs, AI, IoT and advanced analytics are driving rapid adoption of embedded insurance, visual claims and usage-based insurance (UBI).

The rise of intelligent automation, APIs, AI, IoT and advanced analytics are driving rapid adoption of embedded insurance, visual claims and usage-based insurance (UBI).

For many insurance companies, moving their insurance core systems to a vendor’s SaaS insurance platform can seem daunting. There’s often trepidation...

ITC 2022 was one of the most well-attended shows in years. Carriers, MGAs, TPA, analysts, and vendors of all sizes were in abundant attendance, and...

Are requests for proposals actually meaningful and useful, or just another exercise in “covering your assets”? In the hilarious first episode of...

EIS is pleased to announce that we have opened a new office in Cork, our second office in Ireland in the past six months. This new collaborative...

While everyone talks about digital transformation and moving away from legacy platforms, few insurers are doing what it takes to stay ahead of...

Our acquisition of Metromile’s Enterprise Business Solutions (EBS) coincided with a recent report from Accenture and a spate of LinkedIn posts from...

Lassie, the beloved Rough Collie who adorned TV screens throughout the 1950s, ’60s and ’70s, was famous for the devotion and loyalty she showed...

The "Metaverse" is a hot topic right now that often gets confused with “Web3” or “virtual worlds,” and sometimes is seen as just “something gamers...

Learn how insurers can use customer-centric data management to improve customer experience, operational efficiency, and leverage AI for better outcomes.

See what other protection carriers have accomplished with EIS Suite: launching products quickly, decreasing operations time, and improving customer experience.

By consolidating group and individual policies into one platform, insurers can provide simpler, streamlined user experiences.

From increasing personalisation to improving customer experience, this event-driven architecture helps insurers increase & automate customer retention.

Though protection insurance is increasingly price-driven, insurers don’t necessarily have to race their competitors to the bottom.

Though migration can be a complex undertaking for insurers, they have promising platform options to consider.

As protection insurance becomes more customer driven, the lack of support for dual system operations is especially ripe for a solution.

Customer expectations are at an all-time high. Learn how your tech stack can rise to — and exceed — these standards by going truly digital.

Carriers have spent a long time focusing on true group products, with little to no end-customer engagement — let alone personalization. With a group-centric model entrenched into the core of their business, doing an immediate about-face to a customer-centric approach simply wasn’t feasible.

To put it lightly, AI, machine learning, generative AI, and language learning models (LLM) have caused a storm in the business market – including in insurance. It’s left insurers grappling with some pretty big questions. Let’s navigate the noise and pinpoint the real story of AI in insurance today.

Ambition is going to be vital during insurance’s next stage of evolution. Today ambitious insurers are building customer experience as a way to differentiate themselves, expanding products and partnering across an ever-expanding ecosystem to bring new value to customers’ lives.

How insurers leverage human centricity to build a personalized insurance customer experience that meets today’s market demands.

For insurers, balancing premium, investment and income against exposure has always been a challenge, adding CX to the mix raises the difficulty.

How successful underwriters are adapting to new data, AI, and ecosystems to harmonize data and forecast models, identify fraud, and optimize performance.

Four artificial intelligence and machine learning opportunities that will reshape insurance.

The rise of intelligent automation, APIs, AI, IoT and advanced analytics are driving rapid adoption of embedded insurance, visual claims and usage-based insurance (UBI).

The rise of intelligent automation, APIs, AI, IoT and advanced analytics are driving rapid adoption of embedded insurance, visual claims and usage-based insurance (UBI).

For many insurance companies, moving their insurance core systems to a vendor’s SaaS insurance platform can seem daunting. There’s often trepidation...

ITC 2022 was one of the most well-attended shows in years. Carriers, MGAs, TPA, analysts, and vendors of all sizes were in abundant attendance, and...

Are requests for proposals actually meaningful and useful, or just another exercise in “covering your assets”? In the hilarious first episode of...

EIS is pleased to announce that we have opened a new office in Cork, our second office in Ireland in the past six months. This new collaborative...

While everyone talks about digital transformation and moving away from legacy platforms, few insurers are doing what it takes to stay ahead of...

Our acquisition of Metromile’s Enterprise Business Solutions (EBS) coincided with a recent report from Accenture and a spate of LinkedIn posts from...

Lassie, the beloved Rough Collie who adorned TV screens throughout the 1950s, ’60s and ’70s, was famous for the devotion and loyalty she showed...

The "Metaverse" is a hot topic right now that often gets confused with “Web3” or “virtual worlds,” and sometimes is seen as just “something gamers...