Industry Insights

Latest posts

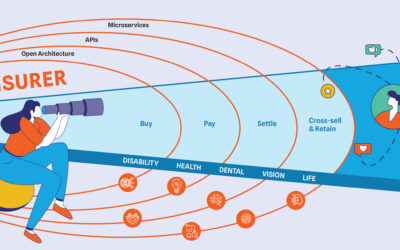

The Brutal Truth About Insurance Go-To-Market Plans

Outdated core systems slow product cycles, stall innovation, and keep insurers from being truly competitive in the market. See how better tooling changes that.

Give Leave Claims the Wakeup Call They Need: Webinar on an Employee-Centric Absence Management Experience

Leave management and leave claims don’t have to be painful. See how industry experts advise insurers to ditch what doesn’t work to put people first.

esure’s Digital Leap: How EIS Helped Reimagine Insurance for the Future

See how esure ditched outdated legacy systems and embraced EIS for faster product development, better customer journeys, and future-proof insurance operations.

Stay ahead with the latest insights right in your inbox:

Keep reading

The Digitisation & Automation of Everything, Even Insurance

Customer expectations are at an all-time high. Learn how your tech stack can rise to — and exceed — these standards by going truly digital.

2023 Gratitude: Another Year of Customer Experience Excellence in Insurance

Discover the innovative customer experience initiatives insurers are taking to make insurance better for everyone, as well as individual stories of gratitude in the face of adversity.

EIS Joins GRiD, UK’s Group Risk Development

In line with our commitment to serving ambitious insurers all over the globe, we’re thrilled to announce we’re now members of GRiD (Group Risk Development) in the UK.

Greater Awareness & Demand for Protection Products

Get the comprehensive overview of the protection insurance industry, including emerging technologies and trends, to create the comprehensive protection package your employees need.

FCA Regulations Aren’t a Zero-Sum Game for Protection Insurers

Discover the many benefits of Financial Conduct Authority (FCA) regulations for protection insurers, and learn practical tips on how to get the most out of your efforts to comply.

Creepy & Kooky Genius: How Would the Addams Family Change Insurance?

Discover how the Addams family could revolutionize insurance, from Gomez as CFO to Wednesday as Head of Fraud Investigation to Thing as Automation Enabler.

Protection’s Big Business Opportunity Amongst Regulatory Changes

Get an in-depth overview of the opportunities that protection insurance presents in today’s rapidly changing market, and discover how insurers can use technology to their advantage.

Coretech Lessons From ‘Frasier’ – Don’t Know What to do With Your Tossed Salads and Scrambled Core Systems?

It’s official: one of TV’s most-awarded shows is coming back after almost 20 years. And while it might technically not have anything to do with insurance, we can’t help but see some incredible connections between the life of Frasier Crane and the evolution of insurance technology.

Get Better Benefits Insights When You Combine Analytics and Generative AI

Discover how combining analytics and generative AI can help benefits carriers unlock valuable insights and streamline operations from customer service to fraud detection.

Revolutionizing Absence Management With an Ecosystem Approach

Numerous employers have had difficulty managing the post-COVID increase in leave requests, due to sheer volume as well as varying (and frequently changing) state-by-state regulations. Without the digital insurance ecosystem approach — and the access to cutting-edge services and technologies it facilitates — truly revolutionary absence management is easier said than done.

The About-Face From Group-Centricity to Customer-Centricity: The Pursuit of Better Transformation in Benefits Insurance

Carriers have spent a long time focusing on true group products, with little to no end-customer engagement — let alone personalization. With a group-centric model entrenched into the core of their business, doing an immediate about-face to a customer-centric approach simply wasn’t feasible.

The AI Surge in Insurance: What’s the Real Story?

To put it lightly, AI, machine learning, generative AI, and language learning models (LLM) have caused a storm in the business market – including in insurance. It’s left insurers grappling with some pretty big questions. Let’s navigate the noise and pinpoint the real story of AI in insurance today.

5 Factors Affecting System Modernization in the Benefits Market

The recent shifts in employee benefits — and the resulting demand on benefit providers’ technology capabilities — means benefits insurers must make fast-paced tech upgrades to keep up. Without the right underlying technology, these enhancements can be difficult to implement, deploy, and manage.

The Winner & Finalists of the 2023 Ambitious Insurer Awards – North America

After hosting the inaugural Ambitious Insurer Awards at ITI Europe, we couldn’t wait to do the same at ITI in New York. The submissions were fascinating, but ultimately 10 were chosen as finalists, and our panel of judges selected one as the winner.

Inflation Mitigation: How Insurers can Protect Themselves Against Price Pressure

As insurers battle rising claims volume and the costs of servicing those claims, the industry must find ways to protect itself against price pressure or see its profits dwindle further. Being adaptive is going to be the single biggest success factor for the industry moving forward. However, that change must go further than moving established processes online.

Reduce Insurance Fraud: Why Insurers Need Machine Learning

Fraud detection in insurance is an arms race. Fraudsters are creating new ways to push through fraudulent claims every day, and insurers are trying desperately to identify and block them the instant they crop up.

Why Ambition is Essential to the Future of Insurance

Ambition is going to be vital during insurance’s next stage of evolution. Today ambitious insurers are building customer experience as a way to differentiate themselves, expanding products and partnering across an ever-expanding ecosystem to bring new value to customers’ lives.

The Secret to Achieving Over 80% Enrollment Rates

Tony Grosso explores how the insurance industry has changed over the past decade and how technology will either be the super power for your growth or your achilles heal.

Takeaways from the Conference Floor: At Insurtech Insights Europe

As new technologies fill the multiple floors of this year’s stellar Insurtech Insights Conference, Rory asks, is something being lost in translation?

Delivering a personalized insurance customer experience

How insurers leverage human centricity to build a personalized insurance customer experience that meets today’s market demands.

Ambitious insurers: Differentiating through value creation

For insurers, balancing premium, investment and income against exposure has always been a challenge, adding CX to the mix raises the difficulty.

How to Supercharge Underwriting

How successful underwriters are adapting to new data, AI, and ecosystems to harmonize data and forecast models, identify fraud, and optimize performance.

Virtual Round Table: A Customer Centric Approach to More Efficient P&C Operations

EIS joined with AWS and Celent to host a “Virtual Round Table” on the topics of customer centricity and efficiency.

Beyond the hype: Four real-world use cases for AI/ML in the insurance industry

Four artificial intelligence and machine learning opportunities that will reshape insurance.

Leadership Spotlight: Jim Caruso, EVP of Customer and Partner Success

EIS’ Jim Caruso discusses how this team will support customer and partner successes and position EIS for even more growth.