Discover how the Addams family could revolutionize insurance, from Gomez as CFO to Wednesday as Head of Fraud Investigation to Thing as Automation Enabler.

Discover how the Addams family could revolutionize insurance, from Gomez as CFO to Wednesday as Head of Fraud Investigation to Thing as Automation Enabler.

Get an in-depth overview of the opportunities that protection insurance presents in today’s rapidly changing market, and discover how insurers can use technology to their advantage.

It’s official: one of TV’s most-awarded shows is coming back after almost 20 years. And while it might technically not have anything to do with insurance, we can’t help but see some incredible connections between the life of Frasier Crane and the evolution of insurance technology.

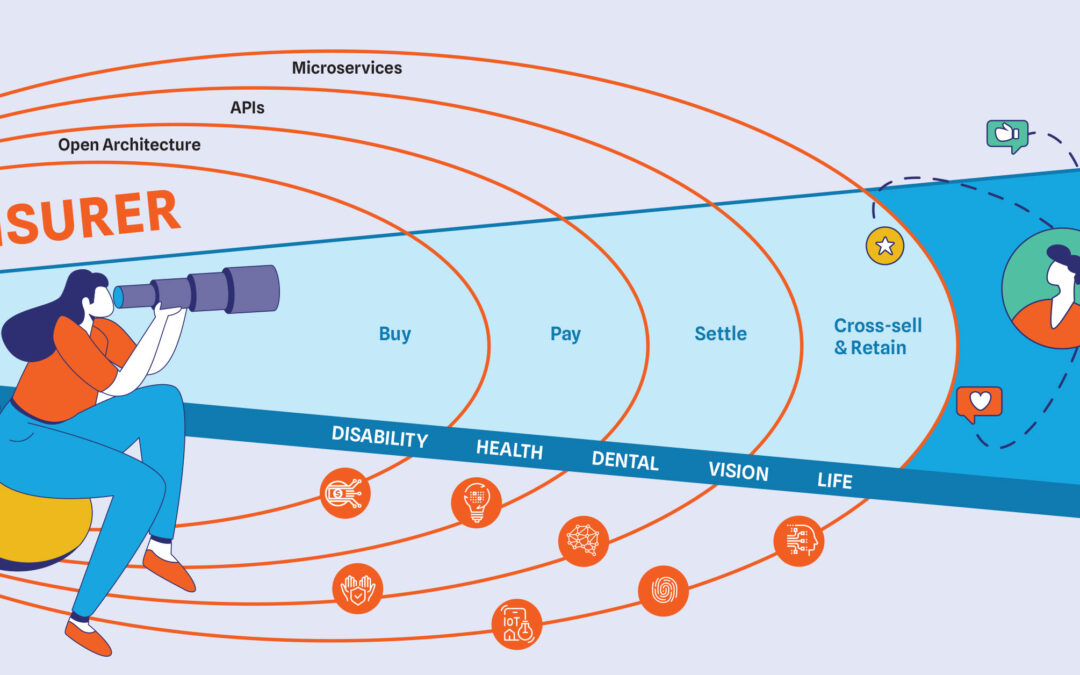

Carriers have spent a long time focusing on true group products, with little to no end-customer engagement — let alone personalization. With a group-centric model entrenched into the core of their business, doing an immediate about-face to a customer-centric approach simply wasn’t feasible.

To put it lightly, AI, machine learning, generative AI, and language learning models (LLM) have caused a storm in the business market – including in insurance. It’s left insurers grappling with some pretty big questions. Let’s navigate the noise and pinpoint the real story of AI in insurance today.

Ambition is going to be vital during insurance’s next stage of evolution. Today ambitious insurers are building customer experience as a way to differentiate themselves, expanding products and partnering across an ever-expanding ecosystem to bring new value to customers’ lives.

Tony Grosso explores how the insurance industry has changed over the past decade and how technology will either be the super power for your growth or your achilles heal.

How insurers leverage human centricity to build a personalized insurance customer experience that meets today’s market demands.

For insurers, balancing premium, investment and income against exposure has always been a challenge, adding CX to the mix raises the difficulty.

How successful underwriters are adapting to new data, AI, and ecosystems to harmonize data and forecast models, identify fraud, and optimize performance.

EIS’ Jim Caruso discusses how this team will support customer and partner successes and position EIS for even more growth.

The rise of intelligent automation, APIs, AI, IoT and advanced analytics are driving rapid adoption of embedded insurance, visual claims and usage-based insurance (UBI).

ITC 2022 was one of the most well-attended shows in years. Carriers, MGAs, TPA, analysts, and vendors of all sizes were in abundant attendance, and...

Are requests for proposals actually meaningful and useful, or just another exercise in “covering your assets”? In the hilarious first episode of...

EIS is pleased to announce that we have opened a new office in Cork, our second office in Ireland in the past six months. This new collaborative...

From M&A to convergence with health insurance carriers, dental and ancillary insurers face a rapidly changing market. But ambitious dental...

While everyone talks about digital transformation and moving away from legacy platforms, few insurers are doing what it takes to stay ahead of...

It’s a challenge to remain competitive in today’s hard insurance market. To do so, insurance companies need to keep policyholders happy while...

Our acquisition of Metromile’s Enterprise Business Solutions (EBS) coincided with a recent report from Accenture and a spate of LinkedIn posts from...

Lassie, the beloved Rough Collie who adorned TV screens throughout the 1950s, ’60s and ’70s, was famous for the devotion and loyalty she showed...

The "Metaverse" is a hot topic right now that often gets confused with “Web3” or “virtual worlds,” and sometimes is seen as just “something gamers...

The thrall of insurtech and its possibilities for innovative customer experiences, product development, and emerging business models continues to...

With the ability to accelerate sales, expand distribution, and simplify the customer experience, perhaps no other trend in insurance has gained as...

Insurance customers want speed and agility. Find out if your software has what it takes.

We caught up with Steve O’Connor, EIS’ EVP of managed services, to discuss his vision for CloudCore and how his team will change the game for EIS customers.

Discover how the Addams family could revolutionize insurance, from Gomez as CFO to Wednesday as Head of Fraud Investigation to Thing as Automation Enabler.

Get an in-depth overview of the opportunities that protection insurance presents in today’s rapidly changing market, and discover how insurers can use technology to their advantage.

It’s official: one of TV’s most-awarded shows is coming back after almost 20 years. And while it might technically not have anything to do with insurance, we can’t help but see some incredible connections between the life of Frasier Crane and the evolution of insurance technology.

Carriers have spent a long time focusing on true group products, with little to no end-customer engagement — let alone personalization. With a group-centric model entrenched into the core of their business, doing an immediate about-face to a customer-centric approach simply wasn’t feasible.

To put it lightly, AI, machine learning, generative AI, and language learning models (LLM) have caused a storm in the business market – including in insurance. It’s left insurers grappling with some pretty big questions. Let’s navigate the noise and pinpoint the real story of AI in insurance today.

Ambition is going to be vital during insurance’s next stage of evolution. Today ambitious insurers are building customer experience as a way to differentiate themselves, expanding products and partnering across an ever-expanding ecosystem to bring new value to customers’ lives.

Tony Grosso explores how the insurance industry has changed over the past decade and how technology will either be the super power for your growth or your achilles heal.

How insurers leverage human centricity to build a personalized insurance customer experience that meets today’s market demands.

For insurers, balancing premium, investment and income against exposure has always been a challenge, adding CX to the mix raises the difficulty.

How successful underwriters are adapting to new data, AI, and ecosystems to harmonize data and forecast models, identify fraud, and optimize performance.

EIS’ Jim Caruso discusses how this team will support customer and partner successes and position EIS for even more growth.

The rise of intelligent automation, APIs, AI, IoT and advanced analytics are driving rapid adoption of embedded insurance, visual claims and usage-based insurance (UBI).

ITC 2022 was one of the most well-attended shows in years. Carriers, MGAs, TPA, analysts, and vendors of all sizes were in abundant attendance, and...

Are requests for proposals actually meaningful and useful, or just another exercise in “covering your assets”? In the hilarious first episode of...

EIS is pleased to announce that we have opened a new office in Cork, our second office in Ireland in the past six months. This new collaborative...

From M&A to convergence with health insurance carriers, dental and ancillary insurers face a rapidly changing market. But ambitious dental...

While everyone talks about digital transformation and moving away from legacy platforms, few insurers are doing what it takes to stay ahead of...

It’s a challenge to remain competitive in today’s hard insurance market. To do so, insurance companies need to keep policyholders happy while...

Our acquisition of Metromile’s Enterprise Business Solutions (EBS) coincided with a recent report from Accenture and a spate of LinkedIn posts from...

Lassie, the beloved Rough Collie who adorned TV screens throughout the 1950s, ’60s and ’70s, was famous for the devotion and loyalty she showed...

The "Metaverse" is a hot topic right now that often gets confused with “Web3” or “virtual worlds,” and sometimes is seen as just “something gamers...

The thrall of insurtech and its possibilities for innovative customer experiences, product development, and emerging business models continues to...

With the ability to accelerate sales, expand distribution, and simplify the customer experience, perhaps no other trend in insurance has gained as...

Insurance customers want speed and agility. Find out if your software has what it takes.

We caught up with Steve O’Connor, EIS’ EVP of managed services, to discuss his vision for CloudCore and how his team will change the game for EIS customers.